Of all the smart habits and rich living ideas and opinions I have shared with you in nearly 300 blog articles, how is it that I have not yet talked about the single most important habit of all, the one that enables us to live life on our terms?

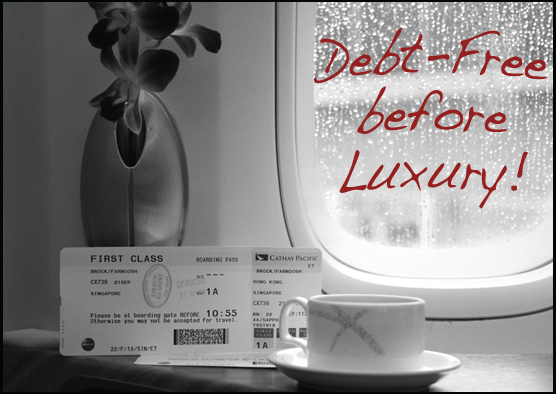

A debt-free life and being in charge of your finances, of course!

This habit has been the core of what has enabled me to always be on top of my finances, and to eliminate debt if any ever appears momentarily. It is what has empowered me to live well below my means, build a nest egg and quit my lucrative job in a tanking economy and lousy stock market to pursue my dream with nothing more than a conviction that I shall succeed on my own.

Maybe one reason I have not talked about it much is due to two assumptions: First, I believed that everyone must naturally keep a close eye on their own finances and second, I found that I may be overstepping my bounds, because after all, your personal finances are your business and you would not want someone else to know about them or heavens forbid, give you advice on them.

Plus, I hold very radical views when it comes to personal wealth and financial independence and I didn’t want to start an uproar.

Not anymore. I think it is high time for me to talk about the state of your finances here, especially if you are hiding behind the curtain of debt and uncertainty without savings or emergency funds. That is the most crucial habit to change in your life if you want to succeed and pursue your dreams on your own terms.

Do I sound preachy and bossy?

I sure hope not!

Just passionate, baby, but let me switch gears and tell you my story.

Immigration, Money, and The Pursuit of Financial Freedom

I am so stubborn.

I shall have what I wanna have, regardless of the odds in my life and in fact, sometimes, despite them and no one will convince me otherwise.

Really, no one.

Persistence can take you the furthest, I believe. The refusal to give up until you have it your way and while it can be a curse if misapplied – you cannot always have it your way in that marriage or that relationship but – you can have it your way when it comes to things that are ENTIRELY in your control and I believe finances fall in this category.

Financial independence has been a serious goal in my life since I was 16 years old. I have not had any qualms about it. I love money. I love luxury. I love wealth. I even love most wealthy people. It is important to be in complete peace with the concept before you make it your life’s mission (well, not the only mission but a mission).

I used to save and account for every dollar.I would go into spending streaks at times but then pull back and never once did I carry a balance on my credit card. If I didn’t have the money to buy something outright, with the exception of my first car and my homes, I would refuse to buy anything. It was really that simple.

Ownership with debt is no ownership at all.

My first job was at a grocery store and it paid $4.25 an hour. My last job, the one I willingly quit in a down economy, tanking stock market (especially for their lousy stock), was a nice lucrative 6-figure income with stock options and bonuses and perks, and I shudder to calculate my obscene “hourly rate”, since it took so few hours to do my simple work. The main motive that enabled me to walk away from it all, besides my stubborn drive and my conviction to do what is right for my future, was the clean state of my finances, a life long project that finally afforded me my freedom.

As an immigrant to the US, I have always been on edge about the state of my finances, always careful and conservative, even if I do spend on luxury. I am starting to believe this may be a gene that some of us immigrants are born with, and it sprouts into full growth as soon as we step at the gates of freedom (and come to embrace whatever is left of capitalism ;)), in my case, in the United States of America.

Now, even though I am a proud US citizen, have an American husband, and live my version of the American life, I am far more fiscally conservative than anyone else in my circle and have lived well below my means. These are the habits that build that financial freedom. This type of fiscally conservative and financially smart life may not sound exciting to you now but the liberating feeling and the freedoms you can afford yourself may just disagree!

A Few Words – or Radical Thoughts – About Money

A few thoughts about money and spending in a tiny nutshell. I love money and believe it can be the root of all goodness in the world. Imagine what can be made possible with money. So much!

People all over the world can put money to bad use but having money, even an obscene amount, does not make one evil – that theory has got to die one of these days because it is utter rubbish – one is evil to start with and money is just a tool, an enabler, just like guns, knives and weapons are but tools that can be put to good or very bad uses. Personal accountability makes all the difference between good and evil. Period.

So if you have hang-ups about having a rich, comfortable life, having a lot of money in your bank accounts, living without debt and pursuing what I like to call obscene wealth – your goals may vary – then I’m afraid this article and the fantastic program that Adam Baker has put together ain’t for you, and I still love you as a reader.

Disagreements rock but clarification was necessary here.

Moving on.

The most successful people in the world are not born rich. The most well-off people are not the children of the rich. They are the children of either immigrants from third or second world countries or people who messed up somewhere along the way but have made it a goal to not only dig themselves out and build a healthy financial empire but also have a mission to teach others to do the same.

So, are your finances in good order?

Honesty would be a good thing here and ignoring it doesn’t make it go away.

The answer must not waver depending on how the economy or the stock market is doing. You must have a robust plan that does not go into pieces when the stock market crashes or when the economy goes bust and companies lay off employees. Who cares if your friends are blowing away their discretionary income on Chicago bears tickets or Gucci purses and luxury boats. Being in debt will bring you a misery that will wipe out all those pleasures in a quick minute.

Think debt-free.

Think savings and emergency funds.

Think a small, manageable but freeing lifestyle.

Think liberating.

Think no clutter.

Think clean and lean.

Think in charge of your life.

Think positive thoughts, think possible, think accessible!

This is one smart habit you can’t afford (no pun intended!) to live without.

9 Ways to Stay On Top of Your Finances

Some of my thoughts as I have lived a clean debt-free life and don’t see debt on the horizon anywhere.

Here are Prolific Living’s 9 quick tips from Brock household to yours:

- Never, ever carry a credit card balance.

- Do not super-size your life to keep up with friends, celebrities or some image of a happy life in the distance.

- Think three times before buying it, if you can’t pay for it with cash, except for a house.

- Have a 6-month emergency fund. If you don’t have it, put a stop to all your extra expenses until you have this.

- Pay your bills before they are due, a few days in advance, and use a strict system to automate the process.

- Call your credit card company to ask a one-time forgiveness if you slip once and end up with fees.

- Talk to your partner, spouse, and family about finances openly. Find agreement in your vision and goals.

- Know your buying impulses and while it’s ok to feed them, control them more than they control you.

- Give others the gift of experience rather than gifts they will not use.

So Did I create an uproar?

Your turn, my darling readers!

What do you think?

Are your finances in excellent shape?

Do you even know?

Are you now motivated to cultivate smart habits toward creating your financial freedom?

Share your thoughts in the comments and share this with someone who can benefit from it!

I am Farnoosh, the founder of Prolific Living. So glad you are here. My mission is to empower you to unblock your creative genius to live your dream life.

I am Farnoosh, the founder of Prolific Living. So glad you are here. My mission is to empower you to unblock your creative genius to live your dream life.